ny mortgage refinance transfer taxes

The recording tax applies to both purchases and refinances but excludes co-ops. Ad Top 3 Independent Reviewers Prefer AAG.

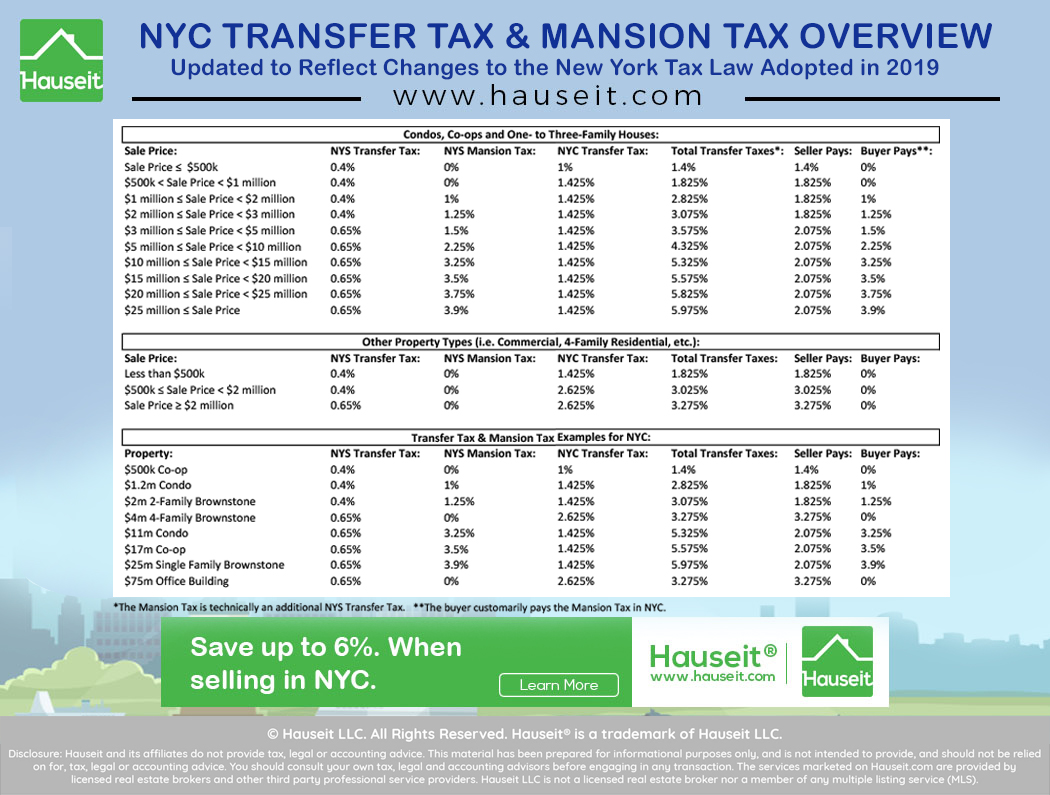

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

AAG is Americas 1 Reverse Mortgage Provider Has Educated Over 1 Million Retirees.

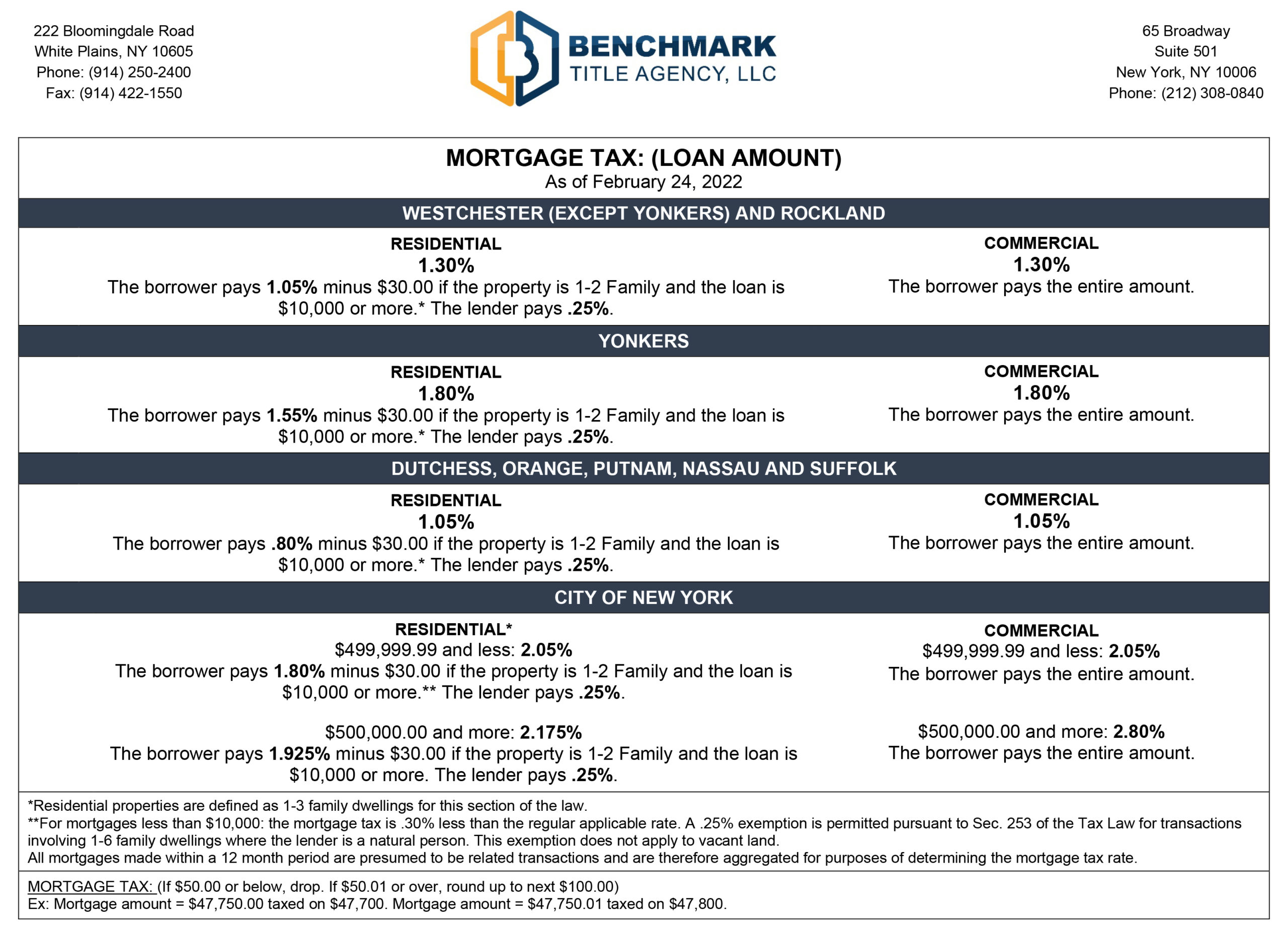

. Refinance Mortgage Tax Savings. The rate varies by county with the minimum being 105 percent of the loan amount. New York City Property Original Mortgage.

If a person is being added to the property deed at the time of refinancing then the person will have to pay the transfer taxes. Ad Our Free Calculator Shows How Much May You Be Eligible To Receive. For borrowers in New York who are refinancing their mortgage the mortgage tax may be reduced if the original lender and the new lender cooperate.

18th May 2010 0533 am. AAG is Americas 1 Reverse Mortgage Provider Has Educated Over 1 Million Retirees. Ad Lock In Lower Monthly Payments When You Refinance Your Home Mortgage.

13th Sep 2010 0328 am. Effective July 1 2021 the amendment to Tax Law 1404 will go into effect. Ad Refinancing Doesnt Have To Be Hard Its Easy With Us.

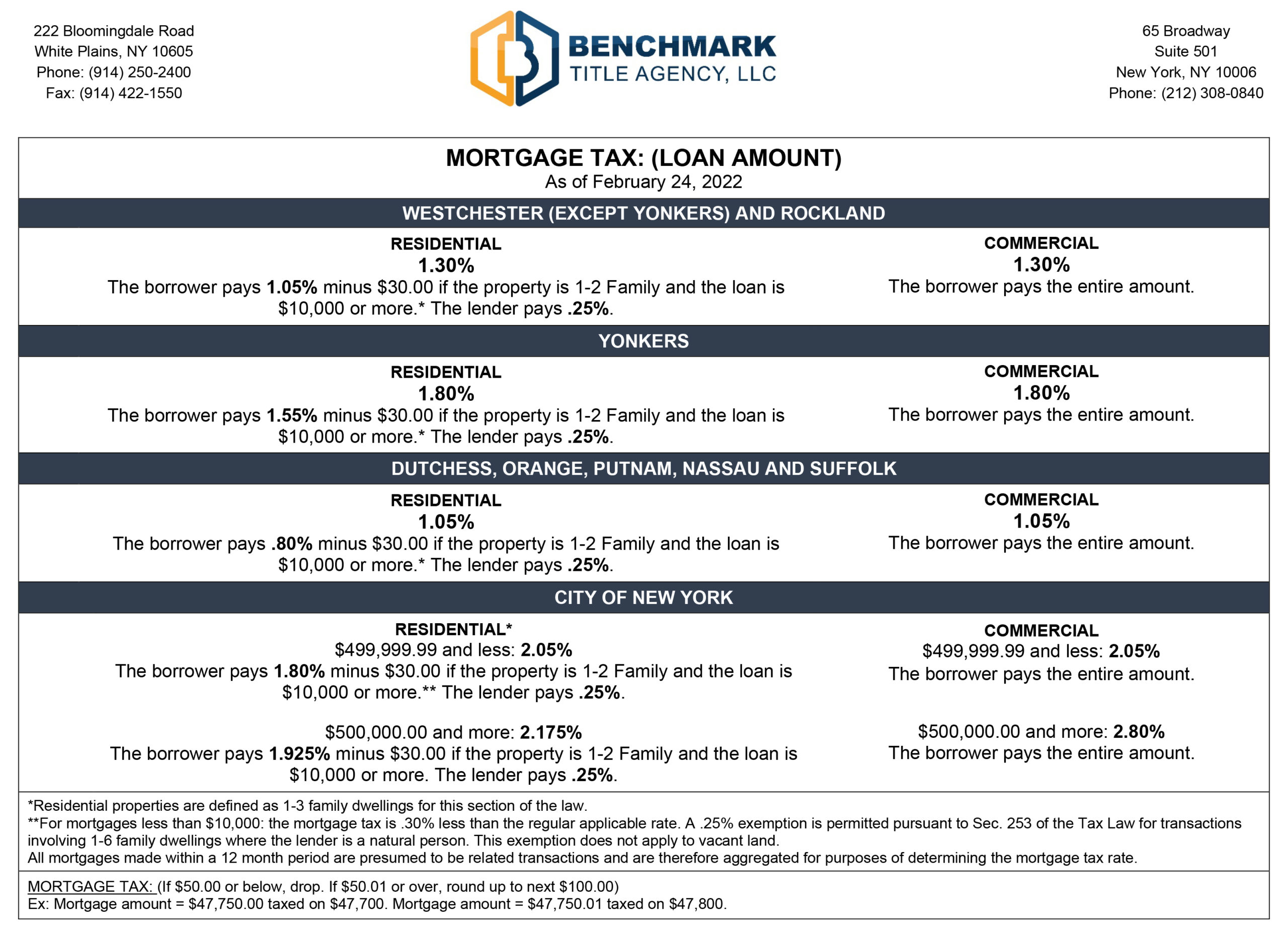

Ad Top 3 Independent Reviewers Prefer AAG. Mortgage Tax is equal to 105 of the total mortgage amount minus a 3000 deduction if applicable which consists of the following. Summary of the Applicable Laws.

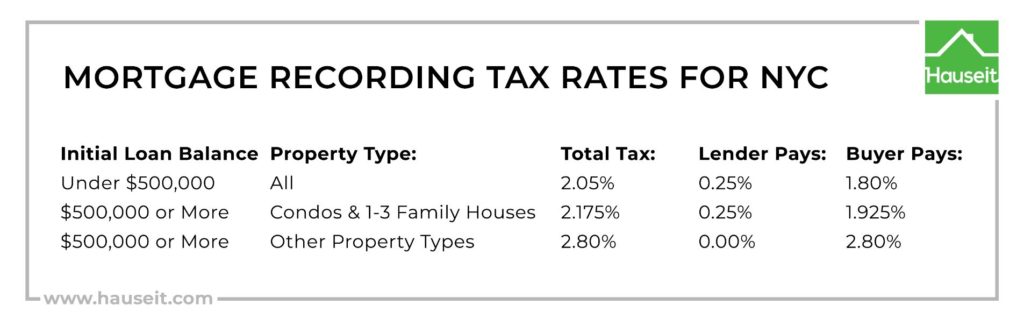

Calculating the Mortgage Recording Tax Rate. One of the provisions of the amended law states. Lender Doesnt Pay any of the Mortgage Tax.

Basic Mortgage Tax is 50 of mortgage amount. Heres how it works. The rate is broken down into the state and local portions.

See What a Reverse Mortgage May Do For You. Say an initial mortgage was for 1 million and the seller paid it down over the time to 900000. Article 31 of the New York State.

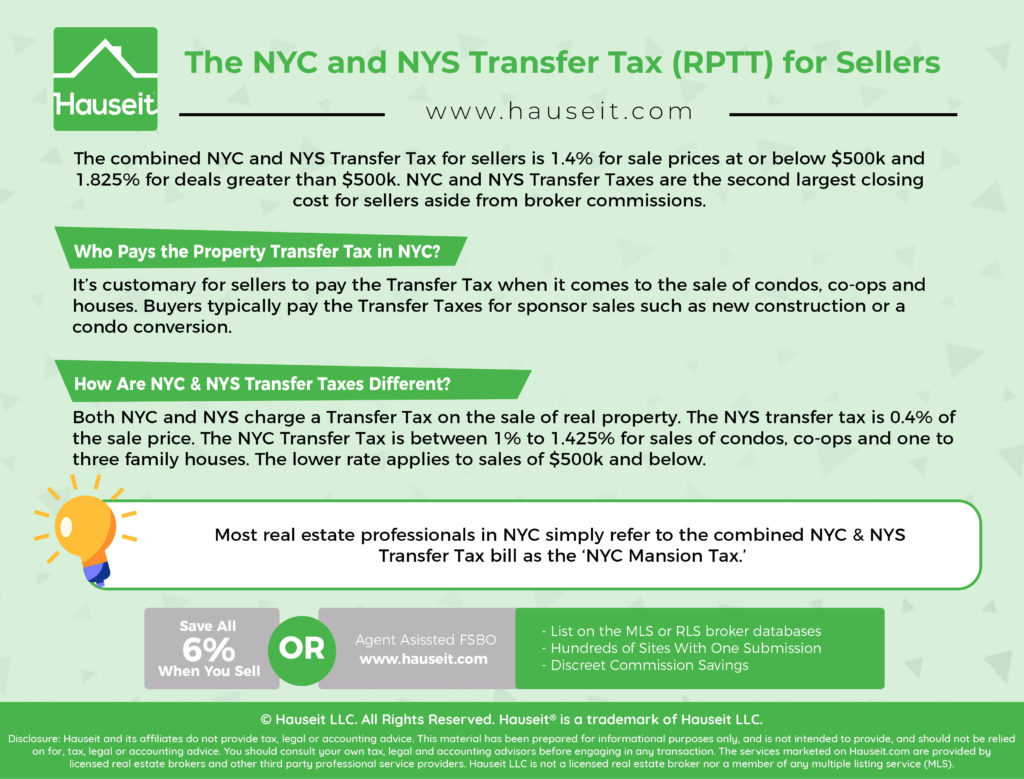

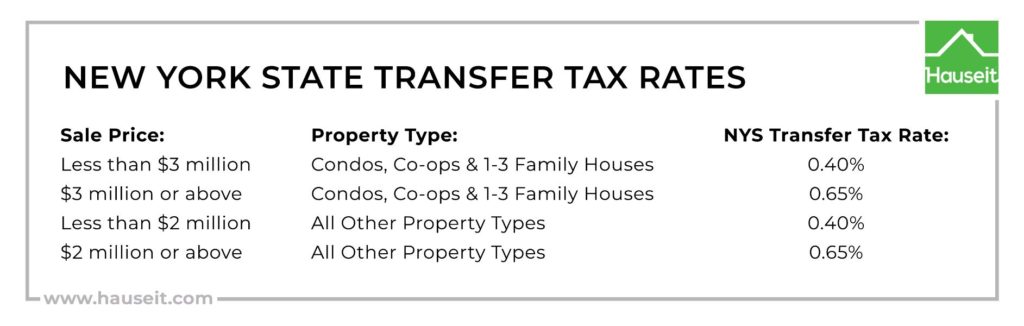

Take Advantage of the Government GSEs Mortgage Relief Product Before Its Too Late. The New York State transfer tax rate is. Comparing lenders has never been easier.

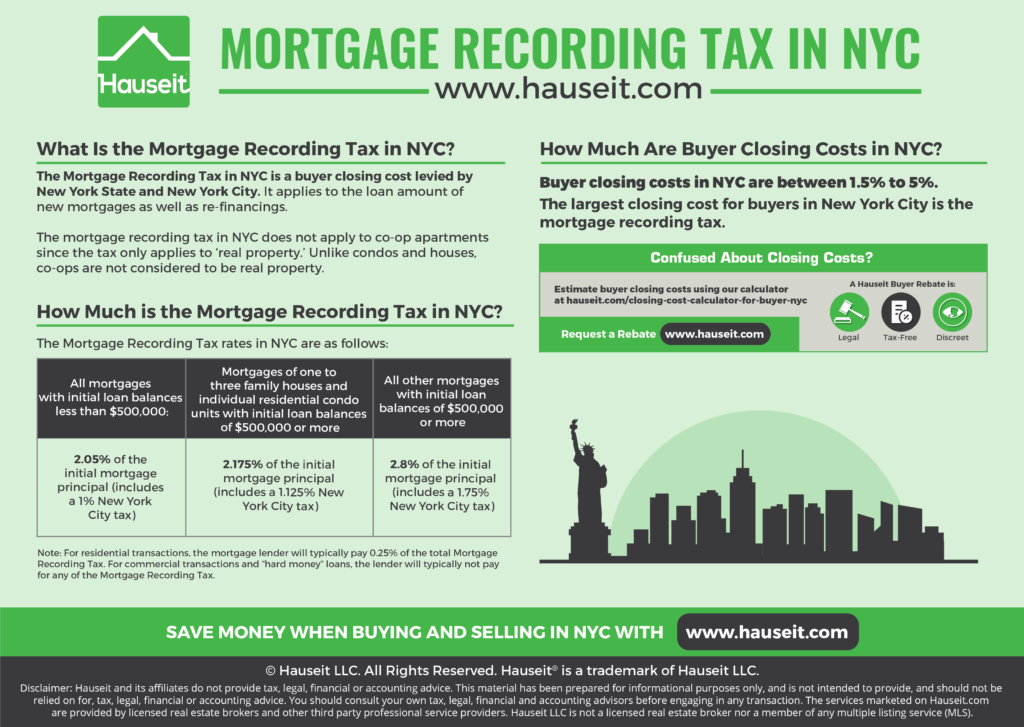

Compare top lenders in 1 place with LendingTree. The rate is highest in New York City where borrowers pay 18 percent of the loan. The tax must be paid again when.

New York State imposes a tax for recording a mortgage on property within the state. In a refinance transaction where property is not. If the mortgage was then assigned for 1 million the buyer.

Lender Pays Part of the. Yes the CEMA process allows you to only pay the mortgage tax on the new money. 700000 Refinance Loan Amount.

The term mortgage recording tax is the colloquial term for a group of taxes imposed by Section 253 of the New York State tax law which includes the basic tax 050. In the case of a conveyance of residential real property as defined. Taxes generally paid by the buyerborrower are due when the.

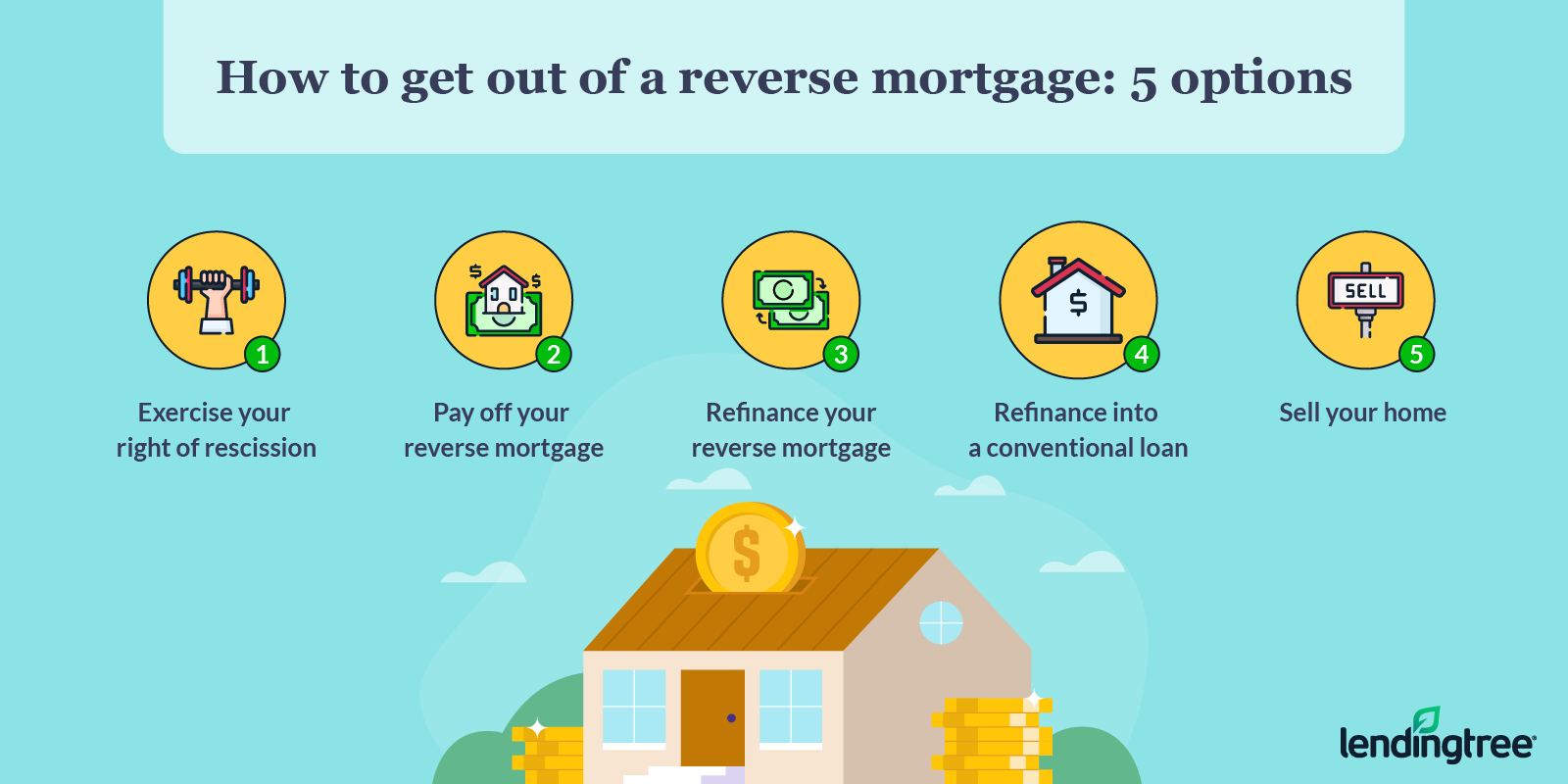

Generally transfer taxes are paid when property is transferred between two parties and a deed is recorded. Yes the CEMA process allows you to only pay the mortgage tax on the new money. The term Jumbo Reverse Mortgage is used to refer to a reverse mortgage that allows a borrower to borrow more than the maximum amount allowable under the HECM program.

For example if you have a 200000 mortgage and are refinancing with a 300000 loan and live in New York City you would ordinarily have to pay a tax of 300000 x 18 percent. See What a Reverse Mortgage May Do For You. On a refinance of a 385000 mortgage on a single-family home in Brooklyn the mortgage recording tax would be 6900 for the homeowner and 96250 for the new lender.

Article 31 of the New York State Tax Law imposes a real estate transfer tax the State Transfer Tax on each conveyance of real property or interest in real. Ad If You Owe Less Than 420680 Take Advantage of a Generous Mortgage Relief Program Refi. Ad LendingTree Makes Your Mortgage Refinance Search Quick and Easy.

Heres an example of how you could save by refinancing with a CEMA loan. 50000 x 18 900. Compare offers from our partners side by side and find the perfect lender for you.

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

Mortgage Rates In New York Plus Stats

Heritus Mortgage Live Transfers Mortgage Loan Company Mortgage Loan Officer

Nyc Mortgage Recording Tax Of 1 8 To 1 925 2022 Hauseit

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

Saving New York State Mortgage Recording Tax Gonchar Real Estate

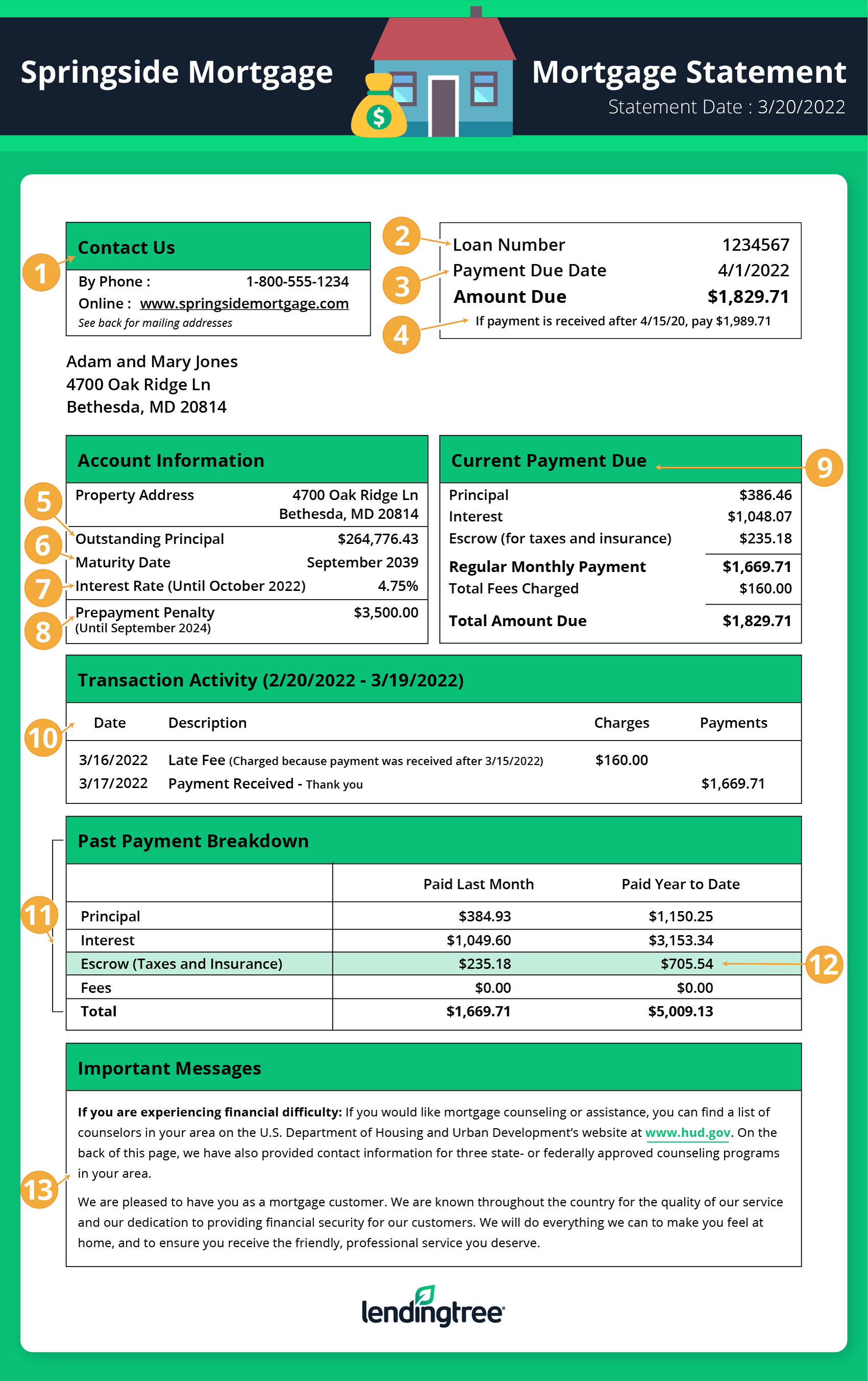

How To Read A Monthly Mortgage Statement Lendingtree

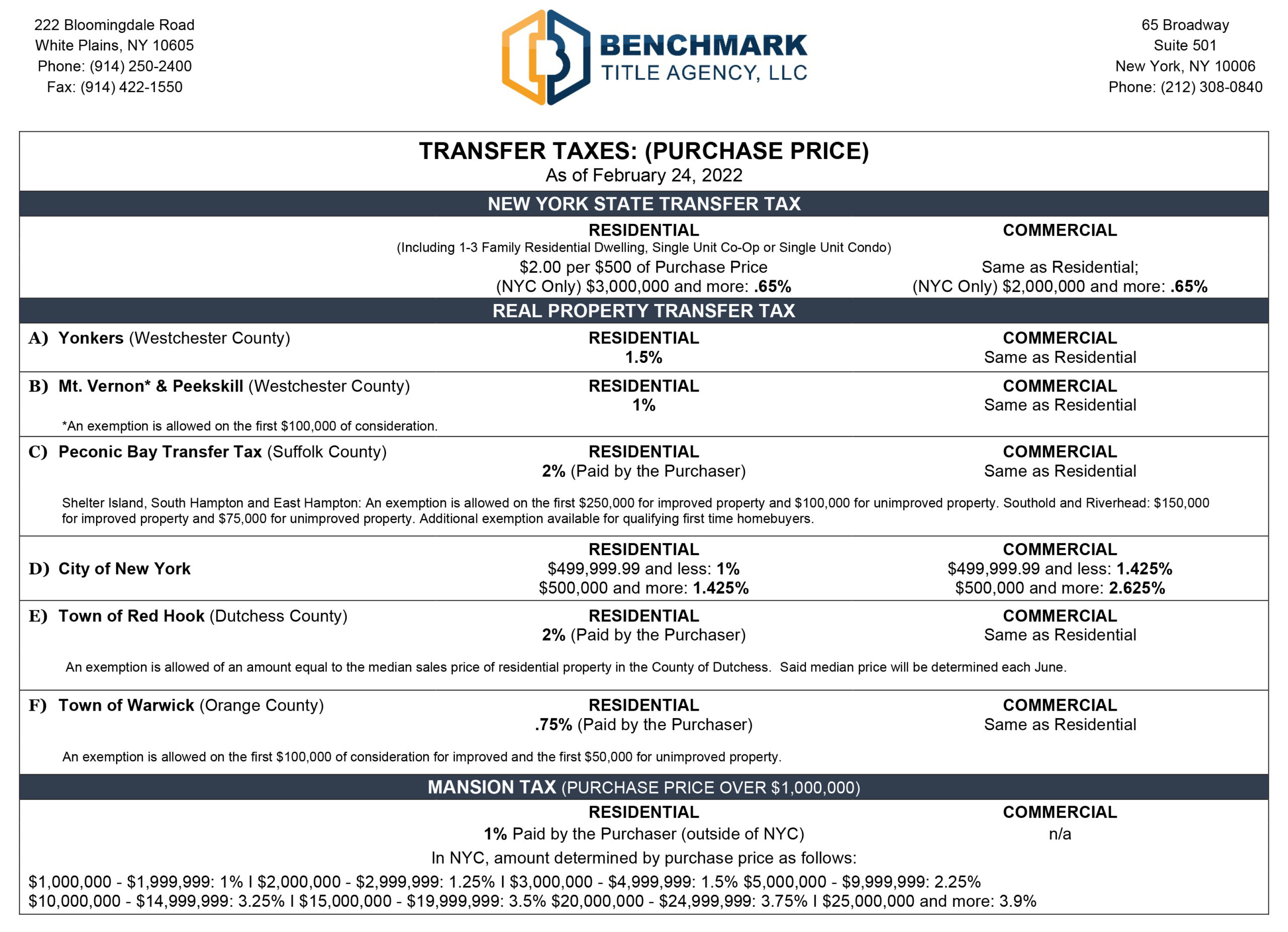

Mortgage Tax Transfer Tax Benchmark Title Agency Llc

Refinancing Your House How A Cema Mortgage Can Help

Mortgage Tax Transfer Tax Benchmark Title Agency Llc

How To Get Out Of A Reverse Mortgage Lendingtree

Mortgage Tax In Nyc Nestapple Biggest Commission Rebate

Reducing Refinancing Expenses The New York Times

Nyc Nys Transfer Tax Calculator For Sellers Hauseit

Nyc Mortgage Recording Tax Of 1 8 To 1 925 2022 Hauseit

Purchase Cema What You Need To Know Blocks Lots

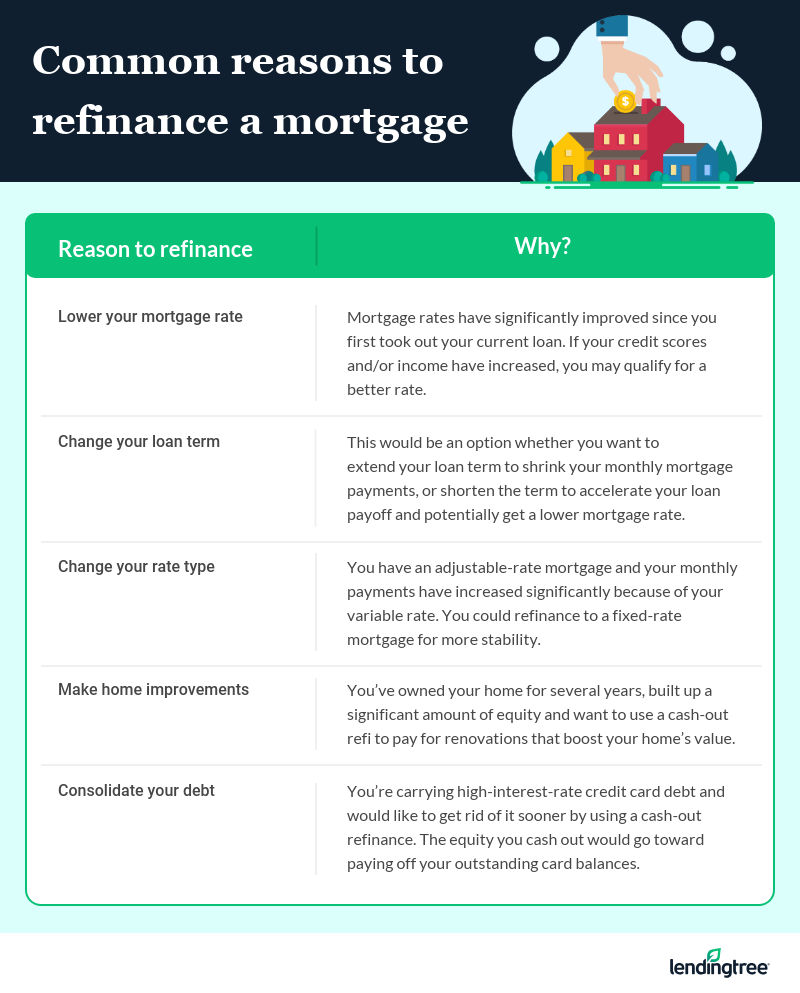

Can I Lower My Mortgage Rate Without Refinancing Lendingtree